The Great Reset: The Evolution of Money Printing

A birds-eye view of Fed and Treasury policy for the past century; what's changed, how it works, and where we stand today.

Welcome to the first newsletter in The Great Reset Series. The goal of this series is to display the structural shifts that has led to the emerging sovereign debt crisis; and today that starts with the institutions at the center of the crisis: The Federal Reserve and The US Treasury.

I’ll keep it short and sweet1.

I had a bunch of readers suggest I put the bullet point summary from last newsletter in the intro, rather than in the conclusion. I can definitely see the appeal, so here it is:

(1) Past: The Fred “prints” money by purchasing Treasury obligations at market rate; historically they purchased gold (through gold certificates), and have since primarily purchased US Treasuries to grow the money supply during 20th century expansion;

(2) Present: Following 2008, the Fed’s traditional approach to monetary policy shifted; they started purchasing Mortgage Backed Securities (agency MBS) and Treasuries in vast quantities; this new period of “abundant reserves” was initiated to provide liquidity in global debt markets;

(3) Future: Kevin Warsh is not a fiscal hawk in the Volcker sense; he’s a fiscal hawk in the spirit of Milton - shrink the Fed’s balance sheet to pre-2008 levels, so all Fed liabilities are simply currency in circulation held by the public. Easier said than done.

Now let’s get at it.

1. The Fed “Prints” Money by purchasing obligations of the Federal Government

To understand why the Fed does what it does, first we should answer a simpler question: what is an “ideal” system of money?

Well, that’s simple enough.

What is Money?

Money is a fungible unit used to transact and exchange goods and services. So the amount of money should roughly scale with GDP. That way, everyone can pay for the goods and services that are being created.

So, how do you make money?

Well, it should be some limited quantity of total assets that are set aside, converted into fungible certificates/tokens, and then are used to facilitate exchange of goods of services in the economy.

Obviously, easier said than done; but at least that’s the theory behind the technology we call money.

What does the Fed do?

The Fed has two mandates: (1) maintain stable prices and (2) foster maximum employment. To do so, The Fed has the sole congressional authority to control the money supply.

For this reason, the general public has the following mental model2 for Jerome Powell’s day job:

However, the public perception that the Fed simply “prints money” ex nihilo, generating wealth and assets for their counterparties that previously didn’t exist, is a little misinformed; albeit directionally correct in today’s regime of monetary policy.

Let me explain.

The Fed prints money by buying assets (this is known as monetization); but the type of assets they purchase has changed throughout the past century. Moreover, what assets they should purchase is a whole other question (and a story for another day).

Today, I’ll just report what they have done in the past, and what they do now. The history of the Fed monetizing assets has 4 phases.

Phase 1: 1913-1933

I won’t bore you with too much of the historical details3, but TLDR; The Federal Reserve System as we know it was founded in 1913 during the Wilson administration after the Panic of 1907. Prior to 1907, there were similar crises in 1873 and 1893 that happened in the absence of an extant Central Bank.

Before this, gold and silver were what everyone considered money; the US Dollar was simply defined as a certain quantity of gold and silver. But US Dollars at this time were not considered money or currencies - US Dollars were simply units of gold (like inches vs. centimeters). Gold was King, Cash was a Paper Promise.

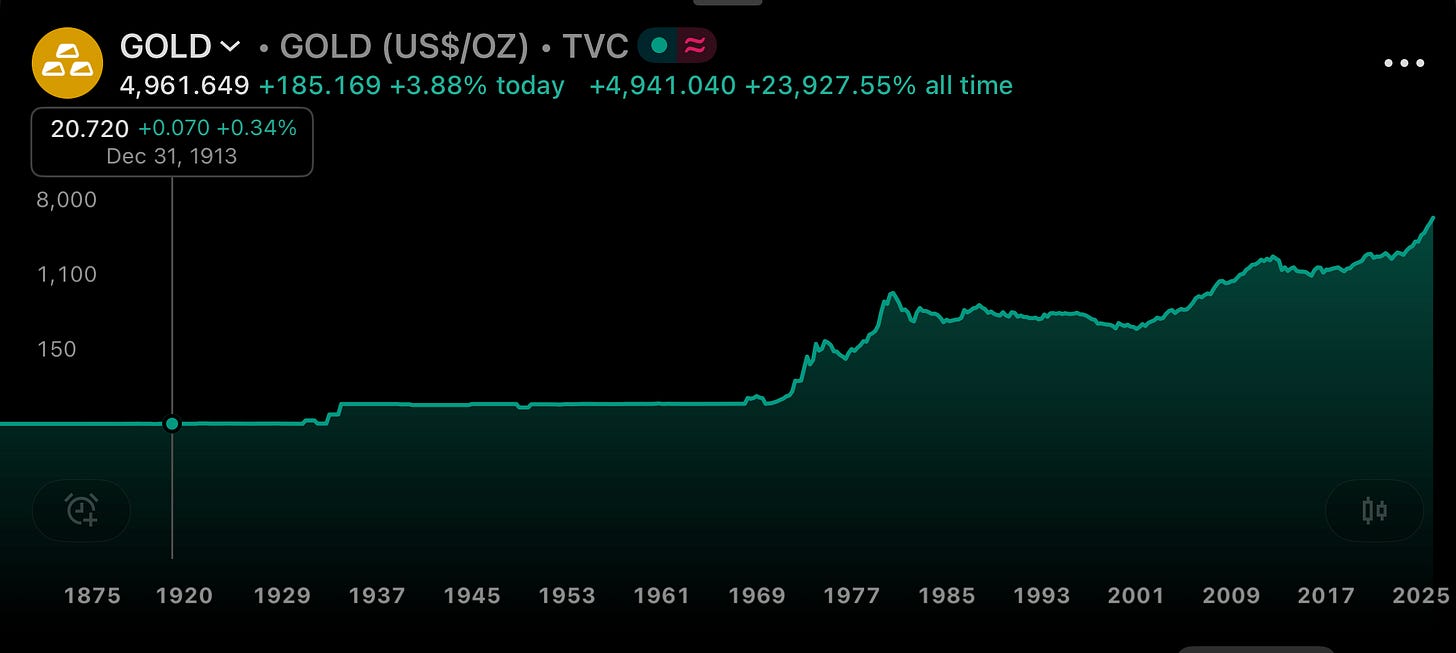

Back in 1913, 1 troy ounce of gold was pegged to exactly 20.72 USD.

Again, that was just the definition of money.

But there’s a problem with gold as the sole unit of money during periods of crisis: there’s only so much of it.

During an economic downturn, pulling money (gold) out of the bank limits the ability of banks to extend lines of credit so that businesses have sufficient liquidity to perform there normal operations.

So back when The Fed was established in 1913, that was its main purpose: be the “lender of last resort” and expand the money supply when people withdrew gold from their local bank during a recession.

How did the The Fed issue more money during these periods of crisis?

Well, they bought Treasury Bonds (just as they do today).

But, critically, at the time Treasury bonds were essentially just proxies for gold. Not gold in the present when they were issued, but gold in the future, since US Dollars were gold.

This is critical to understand. The Federal Reserve Act of 1913 gave the Fed limited power to buy the following “obligations” of the US government:

US Treasury Gold Certificates (directly tied to gold owned by the US Treasury)

Short-term commercial paper (bank notes backed by gold)

US Treasury Bonds (debt instruments that promised future payment, again in gold)

And that’s it!

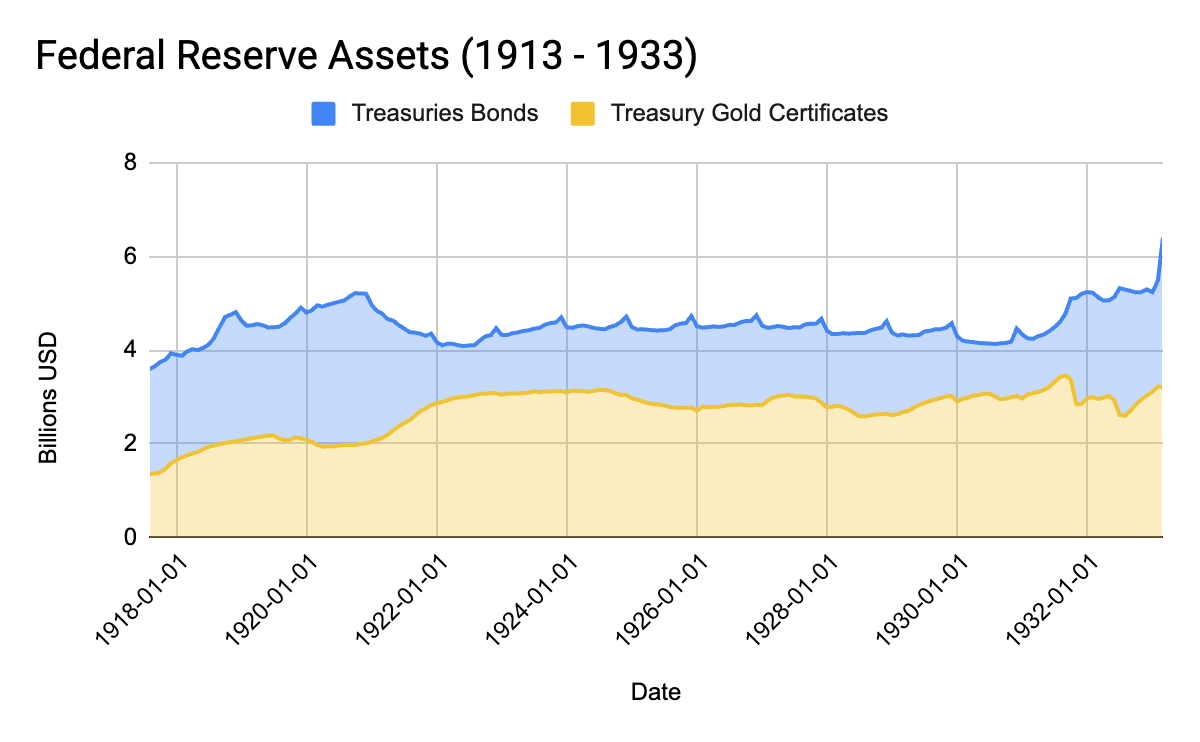

So during this period from 1913 to 1933, this is what the Federal Reserve's assets looked like on their balance sheet:

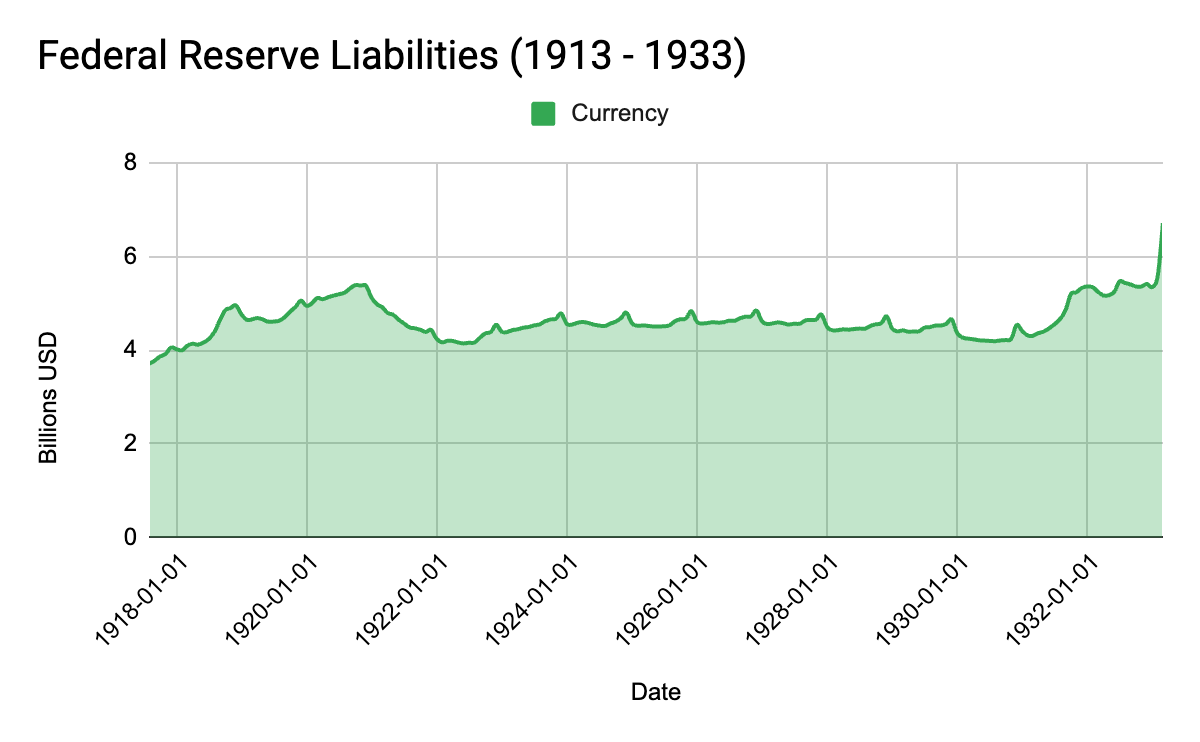

and below are their liabilities during this period:

Here is the main takeaway: during this period currency in circulation and Fed liabilities were one-to-one.

Every Fed liability was simply currency held by the public.

Moreover, every single Fed liability (dollar in circulation) was 100% backed by gold, or some claim on gold in the future through debt issued by the US Treasury.

Even more importantly, since every single dollar in circulation was backed by some piece of gold at the US Treasury, every single dollar was immediately, on demand, convertible to gold at the fixed ratio of 1oz to $20.72.

But that all changes in 1933…

Phase 2: 1933-1971

This officially starts the second phase of the Federal Reserve - and it’s a lesson for what NOT to do during a financial crisis. As we all know, in 1929 the stock market crashed, and this kicked off the beginning of the Great Depression from 1929-1939.

Now, as we mentioned above, the Fed is there to step in and lend during periods of crisis so that there is sufficient liquidity for the economy to continue providing employment and necessary goods and services.

So what did the Fed do in 1929?

You guessed it! They did….

Nothing!4

The Fed chose the path of fiscal discipline, choosing to “liquidate the excesses” of the stock market bubble and unscrupulous lending of commercial banks. They didn’t backstop the banks, they didn’t guarantee balances.

They justdecided to let the economy spiral out of control.

Moreover, to make matters worse, Hoover generally resisted large deficit spending, until it was too late.

From 1930 to 1932, US citizens panic and there is a huge run on the bank. Credit collapses, money gets pulled out of the system, and the Fed does nothing to save it. Prices plummet, businesses go under and unemployment skyrockets.

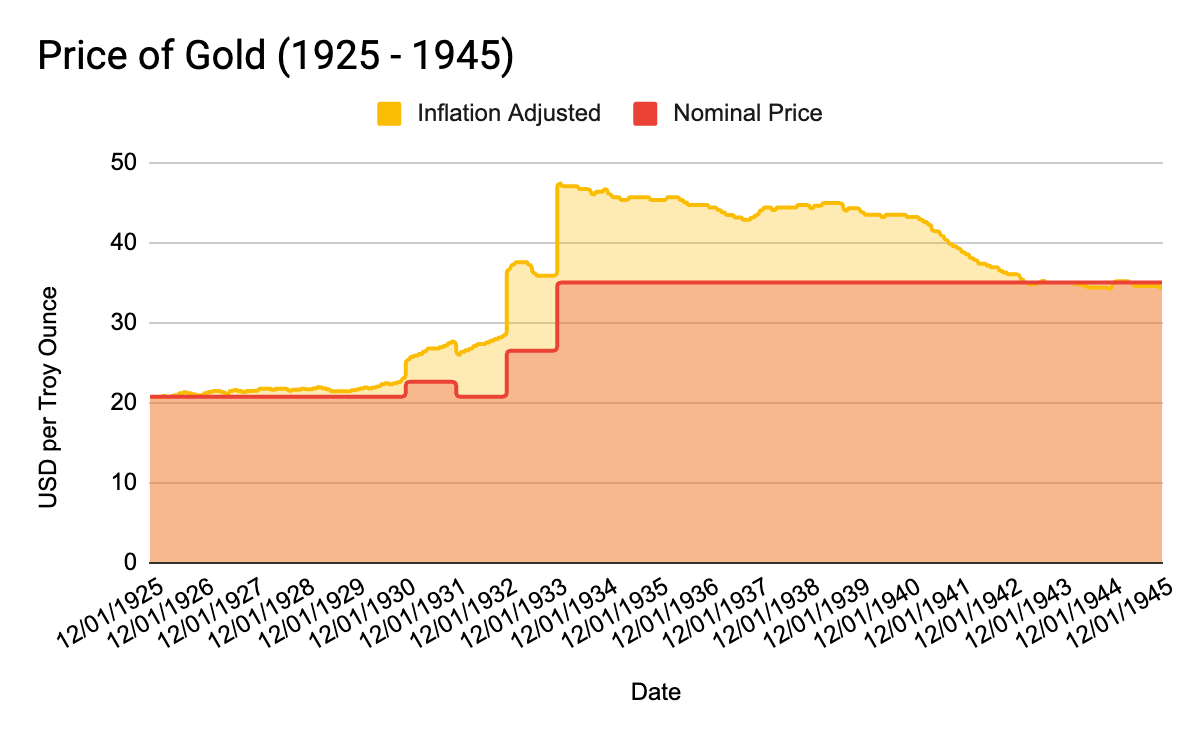

Take a look at the inflation adjusted price of gold during this time:

Now remember, unlike today, the price of gold was pegged to a unit of US Dollars (i.e. the nominal price). So during this period, when the inflation adjusted price is rising, that means the price of everything else — goods, services, labor, housing, etc. — is collapsing.

This is what experts in the industry call a deflationary spiral.

Why does this happen? Because people start hoarding gold, which means they’re hoarding money, which means the less of it there is to go around. That is bad. Very bad. In many ways just as bad as an inflationary spiral (which was happening across Europe on the other side of the Atlantic).

Phase 2A: 1933 - 1955

So the economy is spiraling out of control at this point, and this kicks off what I will call Phase 2A, which is the period from 1933 to 1955. Eventually the state of affairs gets this guy elected:

When FDR enters the scene in 1933, he imposes a bunch of economic and banking reforms; and when I say imposes, I mean dictates reforms… like a dictator!!! No wonder Trump like him so much.

For the purposes of this newsletter, there are two major changes that FDR makes in his first year in office:

All gold must be returned to the US Treasury.

US Dollars are no longer convertible to gold domestically.

The US Dollar is still backed by gold, but only convertible for global trade, not citizens.

Oh, and now you’re dollars are worth less: he re-pegs the dollar to $35/oz of gold vs. $20.72/oz. Sorry! Tough luck.

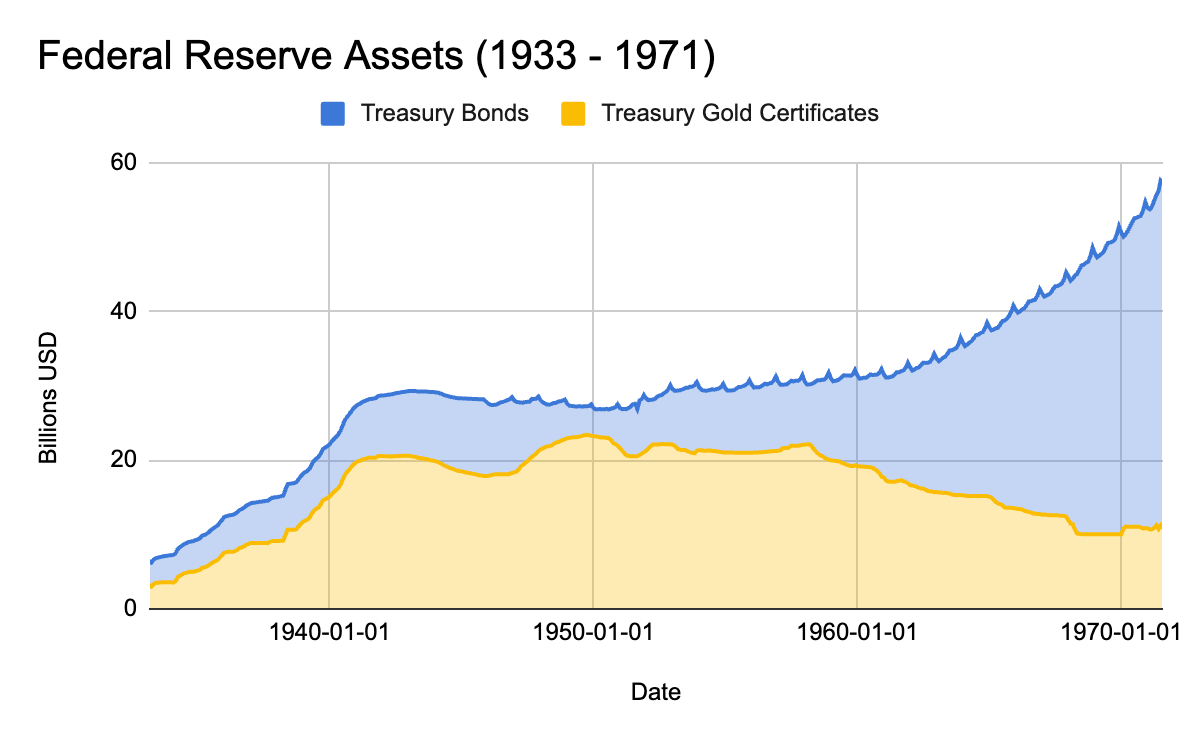

With these changes, the Fed’s balance sheet starts to look very different.

While Europe is collapsing, the US Treasury’s gold holdings are exploding. In fact, for a brief period of time in the 1930s, the Gold Certificates and Treasuries holdings of The Fed actually exceed to currency in circulation.

But at this point, the currency in circulation is very different than it was pre-1933.

For the first time in US history, gold is no longer money. Paper is money. US citizens cannot simply go up to a local bank and convert their dollars to gold. It’s no longer there, it all lives in the US Treasury.

Domestically, the period from 1933 to 1971 marks the end of the Gold Standard for the domestic economy. But the US still uses gold as a clearing instrument for global trade, so at this point the Federal Reserve behaves a little bit like an Exchange Traded Fund (ETF) - where only authorized participants are able to withdraw gold in exchange for dollars (the authorized participants being global trading partners).

So while the US dollar is no longer convertible to gold, it is still in a very real sense pegged to gold. Money is still gold that this point… kinda.

But remember what I said? The Federal Reserve is useful for expanding the money supply in times of crisis, like Wars and Pandemics? Well, in 1955 the US government starts a crisis of our own making….

Phase 2B: 1955 - 1971

This is where things get dicey.

In 1955, the US enters the Vietnam War, and starts deficit spending. At this point, US dollars are still convertible for gold, so the authorized participants that can actually convert don’t really like the US backing the currency by future promises on gold, and not gold itself.

So in 1958, all of our allies overseas that hold a bunch of Federal Reserve authorized US dollars, start to become displeased. Countries that actually have legitimate claims on US gold start converting. From 1958 to 1971, the US Treasury’s General Account at the fed slowly starts getting depleted (famously escalating to the French sending a battleship to claim the gold that backs their US Dollar reserves from the NY Fed).

Over the course of 13 years, the US Treasury’s gold holdings drop by 60% - from over 20 thousand tonnes, down to 8,133 tonnes. But the Federal Reserve manages this depletion of gold certificates by doing what it is authorized to do: it starts buying up a shit ton of US Treasury bonds, which are still valid claims on future payments in gold pegged at $35/oz.

Below is what the trajectory of Federal Reserve assets looks like throughout this period of Phase 2:

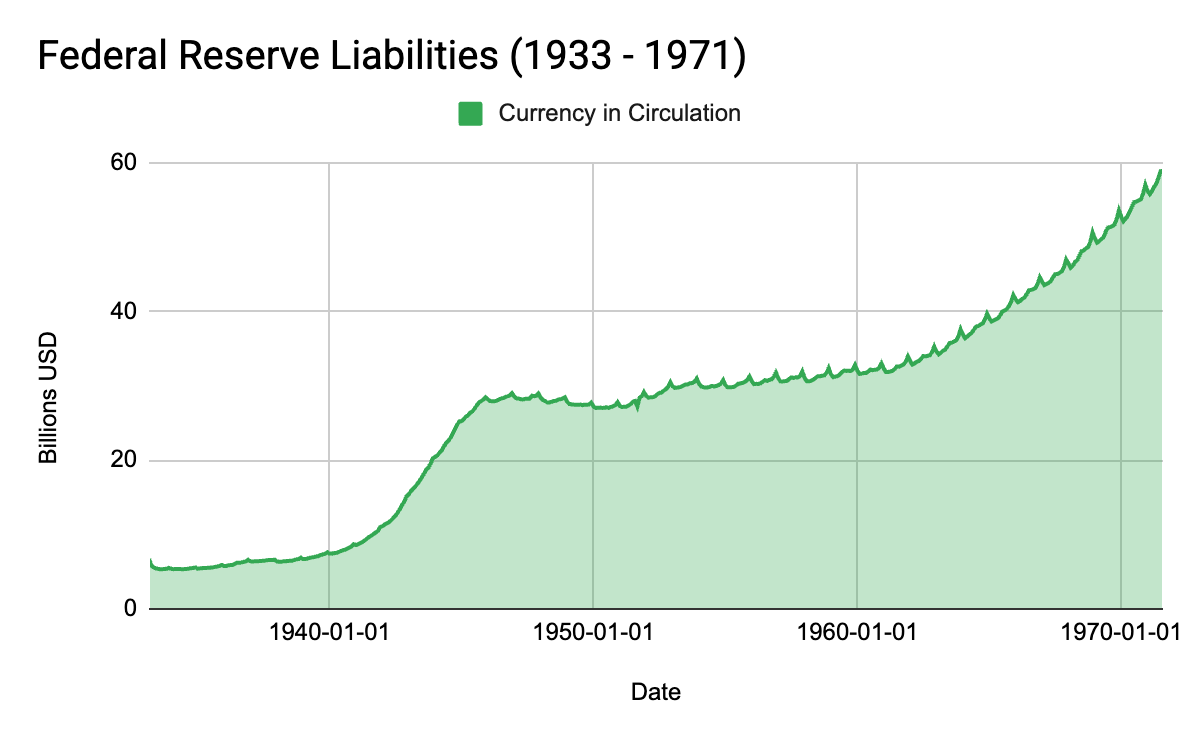

and once again, at this point, it still 100% backs the currency supply held by the public and our trading allies:

But the trajectory of the depletion is untenable - and so, on August 15, 1971 Nixon shocks the world by officially ending the Gold Standard - both domestically and now also abroad.

Phase 3: 1971 - 2008

This is the official start to the monetary regime that we are familiar with: the US Dollar is a pure fiat currency.

Gold is no longer money. Only Federal Reserve notes are money; and if you try to convert your dollar bills into something else at the US Treasury - they won’t give you gold or a treasury bond, they will just return your money to you.

Needless to say, people don’t like this; and the 1970s is marked as a decade of rampant inflation.

But more importantly, now that US Dollars were no longer backed by gold, it doesn’t really matter how much gold lives inside the US Treasury — the Federal Reserve was now free to manage the money supply regardless of the value of gold in their custody.

So that’s exactly what they did!

In this new world, the Federal Reserve buys as many US Treasuries as is needed to meet the demand for dollars both domestically and abroad.

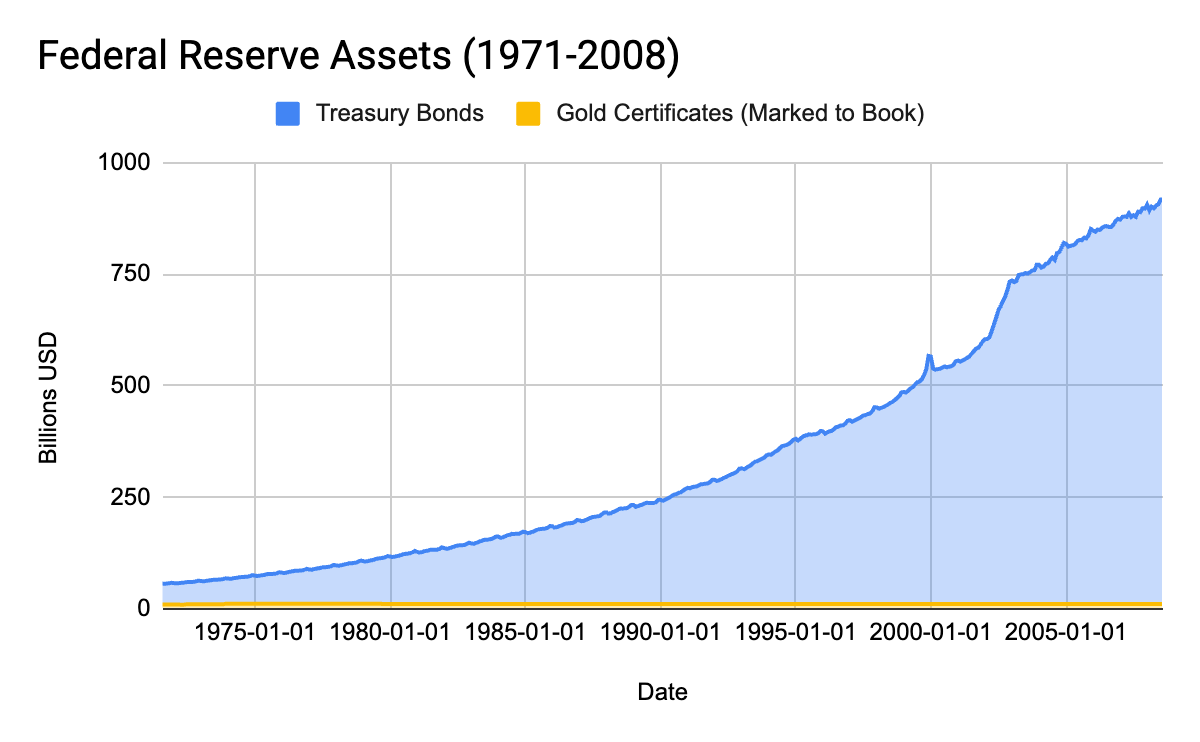

In doing so, their assets begin to expand dramatically (you can barely make out the small little slice of gold assets that the US treasury holds at the Fed - to this day, the US Treasury’s gold assets are marked-to-book at $42.22 per ounce):

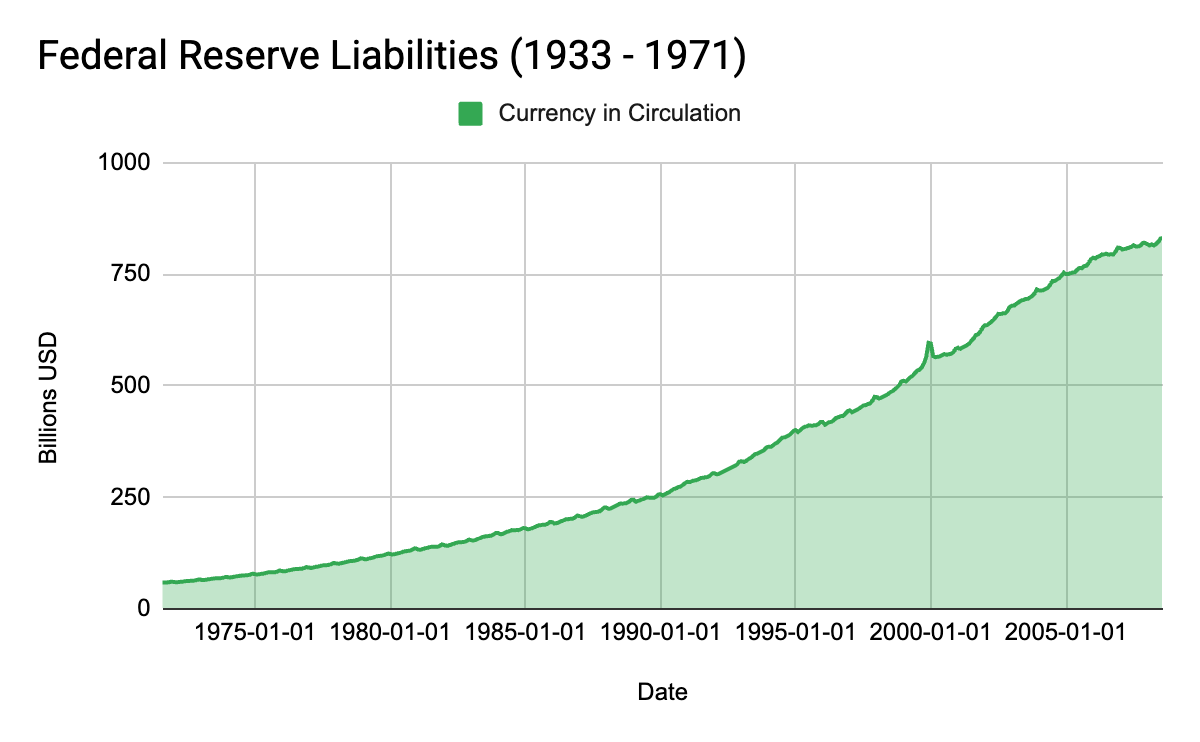

and the money supply expands in turn:

At this point, our system of money starts to get a little weird… here’s the rundown:

Historically, the Fed had the authority to issue currency (Fed liabilities) by purchasing liabilities of the US government (gold certificates and Treasury bonds)

But Treasury bonds were just claims on dollars that themselves were redeemable for gold.

So before 1971, everything was still essentially a gold certificate - dollars and Treasury certificates were redeemable on demand for gold, and Treasury bonds you had to wait a little, but eventually you would get your gold back.

But NOW, after the Nixon Shock, Treasuries bonds were redeemable for dollars, which were just backed by Treasuries bonds that the Federal Reserve purchased.

So in the world post 1971… US government debt is essentially just backed by…. more government debt??? Yep, that’s essentially how it works.

Ok, so it’s a Ponzi scheme.

It’s almost like Bitcoin: just a clever ledger system that’s supposed to keep track of who owes whom. But it only has value as long as the incumbents get paid back by the latest entrants.

How ironic.

I digress.

But if that isn’t weird enough, in 2008 things get really juicy. This system of a pure fiat currency, where the Federal Reserve creates dollars by purchasing Treasury bonds, that are themselves used to service the Treasury Bonds (I know, confusing), goes into overdrive when we arrive at our next major crisis:

The Great Financial Crisis (GFC).

2. The Fed enters a regime of abundant reserves; the public is no longer the majority holder of USD.

The year 2008 represent the 4th (and second to last?) phase of the US dollar. As a recap, at this point, all the assets on the Fed’s balance sheet represent US dollars in circulation (currency).

Moreover, prior to 2008, essentially everything on the Fed’s balance sheet (according to their book value) are just US Treasury bonds. So US Treasuries are the assets the Fed purchases to print currency, and currency is what is used to pay the Treasury bonds.

But then 2006 hits, and more radioactive debt hits the economy and the Fed has to intervene because this paper is just as astronomically large as the Federal Governments debt: Mortgage Backed Securities, which are technically also backed by the full faith and credit of the US government.

Oh yeah. We’re doing it.

Turn on Phase 4.

Phase 4: 2008 to Present

This is where things get really weird (as if it wasn’t already weird enough).

At this point, the housing market crashes, and the US public is now underwater on the majority of their mortgages. All these mortgages have been sold on the open market as high grade commercial paper - (1) “because who doesn’t pay their mortgage”, and (2) they are backed by the Federal Government through Fannie Mae and Freddie Mac.

To save the global financial system, the Federal Reserve now steps in as the buyer of last resort (not the lender of last resort as they were originally intended to be); and so they start buying up all the currency swaps, mortgages and treasuries that they can get their hands on.

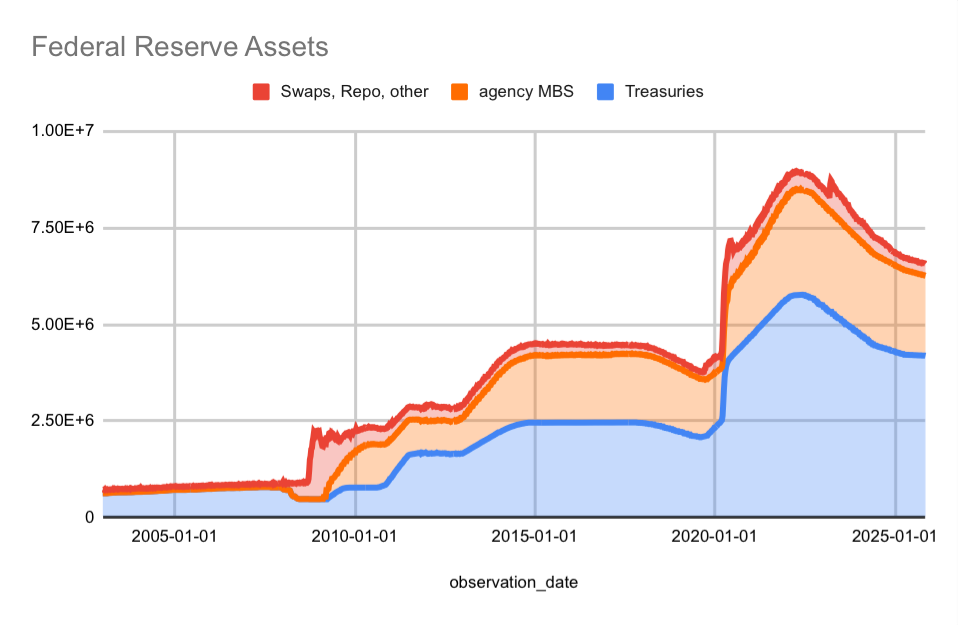

Here is the Federal Reserves balance sheet from the end of Phase 3, to the present day:

Notice how small the balance sheet was in the pre-2008 world compared to Today. In the past 20 years, the balance sheet expands from under $1 Trillion USD, to over $7 trillion, peaking to over $9 trillion USD following the COVID-19 pandemic.

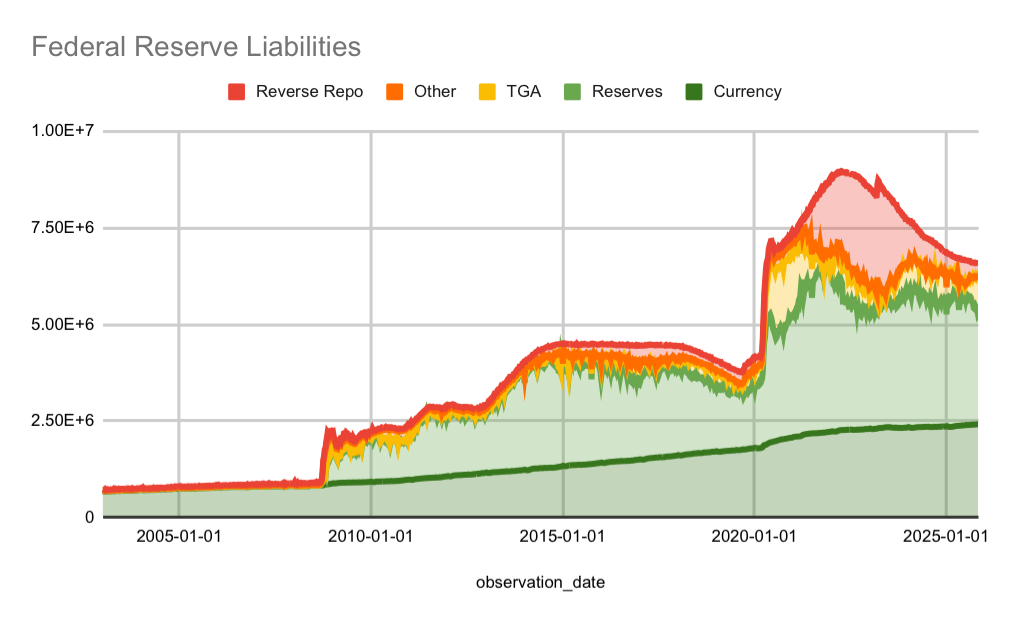

Even more interesting, you can see that something weird happens to their liabilities:

For the first time in the Federal Reserves history, the liabilities of the Federal Reserve now longer track the currency in circulation.

This new world is called the regime of abundant reserves (as opposed to scarce reserves, when nearly all the Fed’s liabilities circulated as currency in the economy).

Now in this new monetary regime, the vast majority of Federal Reserve liabilities are NOT US dollars that live on the balance sheet of the American public, but instead live on the balance sheets of the Fed’s banking members.

You know their names:

JPMorgan Chase, Bank of America, Citibank, Wells Fargo, Goldman Sachs, Morgan Stanley, among others.

So in summary:

(1) the US Congress issued Treasury bonds to fund deficits during periods of economy expansion, not crisis,

(2) the banks then issued mortgages to American households and created a housing bubble - both of these debt instruments are backed by the US government, and so:

(3) The Federal Reserve purchased these junk bonds (yes, I’m calling US Treasuries junk bonds supported by a circular Ponzi scheme) - and then allowed the majority of US dollars they issue to be absorbed by the balance sheets of the very institutions that created the crisis.

(4) the deal is that these US Dollars that are marked to book, but definitely not marked to the market value of these junk bonds they purchased, so the banks can keep the book value of their balance sheets alive.

Got it? Great. Sounds good.

I’ll just close this section by reminding everyone that The Fed has not technically changed its mechanics since 1913; it has always, and continues to, supply money by buying assets that are exclusively obligations of the Federal Government. The assets they have purchased have evolved over time:

First it was Treasury gold certificates

Then it was US Treasury bonds in times of crisis

Then it was Treasury bonds paid in fiat that were produced by more Treasury bonds

The it was agency Mortgage backed securities, that were obligations of US government agencies

And sure, did this system of buying Treasuries turn into a circular fiat Ponzi scheme?

Yeah, you bet.

But did the Fed ever abandon it’s principles and generate wealth out of thin air?

Technically no.

In 2008, it just decided to pull the rancid stuff off of the bank’s balance sheets, and in exchange give them the same US dollars that you and I get in return for work that we do.

So does that mean the value of labor is equivalent to rancid junk bonds?

Hmmmmm… I’ll let a future populist uprising answer that question.

The question remains though, what remains for the next (and final?) phase of the Federal Reserve System? Enter stage left, the infamous Kevin Warsh.

3. The future of the Fed; Kevin Warsh is a not the hawk you’re looking for

So what happens next? Everyone is calling Kevin Warsh a fiscal hawk that “hasn’t seen a rate hike he didn’t like” — despite campaigning on lower interest rates to placate the current administration.

But once again, much like the media’s confusion around metals volatility that I discussed earlier this week, Warsh was never critical of low interest rates in general: he is primarily critical of abundant reserves, and sees low interest rates + abundant reserves leading to persistent and rampant inflation (like what we say in 2021).

So no, he’s not a Volcker style fiscal hawk - he’s more like what you would expect to see if Milton Friedman had the opportunity to control The Fed. He comes from a peculiar lineage of academic thought where persistent inflation has very little to do with endogenous factors, and almost exclusively to do with abundant reserves and the supply of money.

Just watch this interview he did with the Hoover institute last year:

So in his perspective, money is less a stool for employment, credit and prices - and more like a commodity that rises and falls in value as it grows and shrinks in scarcity.

Now, was this position of his misplaced during the height of the Great Financial Crisis?

Yes, probably.

The biggest concern during the GFC was a deflationary spiral, much like what we say during the beginning of the Great Depression (discussed earlier). During the crisis, keeping rates low, and providing as much stimulus as possible was the right move.

But what about since then?

Should the Fed perpetually be in a state of abundant reserves?

Should a single institution hold nearly 25% of US GDP on it’s balance sheet?

Maybe that’s what you need to preserve the fiat currency Ponzi scheme we’ve been running for 50 years?

Or maybe not?

Maybe it’s time we find a way to reverse Federal Reserve’s control over the global financial system.

Maybe if liquidity for Treasuries and sovereign debt is weak, that is the market saying we need a debt jubilee, and not a signal that we should keep juicing the order book.

Maybe reserves shouldn’t be so abundant.

Maybe, while we are in the process of renegotiating the New World Order, we should take some time to come together and ask ourselves:

If the First & Second Central Banks of the US only lasted for 20 years each, and collapsed under revolts of the working class against the excesses of our nations financiers, maybe the Third Central Bank should go softly into that good night after it survived for over a century?

Or maybe it will just rage against the dying of the light.

At the very least, it’s probably wise to learn from our past and reform the Central Bank before it is once again forced to dissolve itself under a populist revolt.

That’s all.

Talk soon.

Oops, I did it again - long exposé. Sue me.

Ok fine, maybe I will bore you with the details in this footnote. Before 1913, the US had a history of creating central banks that were given a 20 year shot clock that had to be renewed - they both died at the end of their charter period. The entire foundation of the US is actually kind of a battle about whether or not the government should participate in banking - with the Jeffersonian side of the Founding Fathers being deeply opposed.

The first one was founded in 1791, and died in 1811. While Jefferson didn’t oversee the end of the First Bank, most of the work during his presidency was to delegitimize it after he seized power from the Federalist Party (the first ruling party in the US), who was lead by Alexander Hamilton, a major proponent of the central bank and first Secretary of the Treasury (go figure).

Jefferson and Hamilton had major beef, and Jefferson (along with many others after him) actually argued that under Article 1, Section 8, founding a central bank was not one of the enumerated powers of Congress, and that banking should be managed by the states. Whereas Hamilton argued with the same clause that Central Banking was “necessary and proper” to execute on enumerated Congressional powers like borrowing, taxation, regulating commerce, etc.

In hindsight, it’s quite amusing that Hamilton still lives on the $10 banknote, whereas the $2 banknote that housed Jefferson has been pretty much lost to history. I digress.

Anyway, the First Bank officially died during the Madison administration (who was a Jeffersonian democrat and also didn’t like the central bank) — but then the US got pulled into war with Great Britain again in the War of 1812, and for anyone that knows anything about history, not having a bank that can manage the money supply and provide liquidity for debt financing, knows that going to war without a national bank is a really really bad idea.

So after the War of 1812 ended in 1815, the Second Bank was established in 1816… and then was promptly killed by Andrew Jackson in 1836, who essentially ran on an anti-bank platform and pro Yeoman suffrage campaign. His presidential campaign advocated that the Central Bank and financial system in the US actively worked against the interest of the Yeoman working class (sound familiar???) — in 1832 he campaigned on abolishing the Second Bank which was up for renewal in 1836 (and actually vetoed its recharter bill during his campaign in July 1832); this proved incredibly popular and he won, ending the Central Bank system in the US for almost a century.

Anyway, the gist is that the early 19th century was defined by anti-bank pro-working class politics with a string of presidents that actively hated the idea of centralizing power to a semi-private bank that was a surrogate of the Federal Government — Jefferson [1801-1809], Madison [1809-1817], Monroe [1817-1825] and Jackson [1829-1837]. There was also John Quincy Adams in between Monroe and Jackson…. but everyone hated that guy. In fact, fun little piece of history, in the 1825 Presidential Election, Jackson actually won the most electoral college votes, but was defeated by Quincy Adams when the House of Representatives voted in his favor.

So there’s a lesson here: Central Banks are critical when countries need to rely on debt financing Wars and economic shocks (Revolutionary War —> First Bank, War of 1812 —> Second Bank, Civil War —> centralized currency, Greenbacks, but avoided centralized banking, Panic of 1907 —> Federal Reserve System), BUT they inevitably become deeply unpopular in the fullness of time when the working class revolts against the financiers and capitalists. Unless you’ve been living under a rock for the past 20 years, this is starting to sound very very familiar…

Well technically not nothing. They did step in briefly to stabilize the stock market - but only momentarily. Once the flash crash stalled, they stepped away and decided NOT to expand it’s balance sheet. Big mistake.

Nice recap Nic. Obviously the petro dollar and the world reserve currency factor in here as well - and not in a good way for our economy or the fed, I imagine. Now we have global pushback against the dollar resserve in the form of oil producing nations taking other currencies for their product, BRICS pay and the upcoming Ripple settlement system which will move global settlement onto the blockchain and away from the dollar. Add to this the presumption that the Trump administration may actually favor removing the dollar, or at least significantly reducing it's role, as the reserve currency. This all makes it difficult to make any preductions - especially about the future. LOL