Metals Volatility is a Problem of Our Own Making

A historic shift in performance bond policy at the CME shapes the new volatility regime for metals markets.

First, some house cleaning.

Back in the fall I promised a series of newsletters outlining the emerging sovereign debt crisis.

Since then, I’ve been swept away building a company aimed at minimizing the friction felt by the physical metals industry — with the primary goal of stabilizing prices and driving down spreads for the end-user (from retail investors, to industrial consumers).

This new workload has imposed major time constraints on my natural approach to writing: long form newsletters, that are packed with information — hence the delay.

So I’m going to try something new.

Rather then push out 10-thousand word exposés that live in my comfort zone as a writer, I’m going to prioritize brevity and frequency to (1) meet the demand for information in a rapidly changing industrial and monetary environment, (2) give myself enough time to keep building.

Plus, there’s enough verbose AI slop out there designed to keep you scrolling and boost engagement metrics. So I’m going to try something a little more human: direct1 and filled with insights.

To quote a past student of mine, “please say more, with less”.

Heard.

Before getting into the Great Reset Series, I’m going to practice this new format2 with a topic that has been on my mind this week… the recent volatility in metals markets and the true culprit of this market mayhem: The Chicago Merchantile Exchange (CME) and their major policy shift on performance bonds.

After pushing this one out, I promise my Great Reset series will come in short order — within days rather than months.

Let’s get at it.

1. CME’s new margin policy is the main driver of recent volatility in commodities pricing.

The narrative that the media has run with: “precious metals are the new meme stocks”.

This is obviously false.

If precious metals were truly the new meme stocks, driven primarily by retail investors and leverage, then the SP500 and the Nasdaq composite, which are bundled in menagerie of ETFs, and tokenized on every shitcoin exchange you could imagine, would also be experiencing 5% daily price swings. They don’t.

Commodities markets (some of which are 10s of trillions in market cap, with 100s of billion in trade volume), just like US mega-cap stocks, have more than enough market participants to keep prices stable.

So what actually has driven recent metals volatility?

For over a century, CME had the same rule: to initiate a futures contract, you needed to post some cash that would absorb the price fluctuations of the contract from now until the date of the delivery. This so-called “performance bond” has always been a fixed dollar value, roughly equal to 3-5% of the asset price.3

Setting a fixed dollar value makes cash requirements predictable for clearing members that buy and sell futures on the exchange.

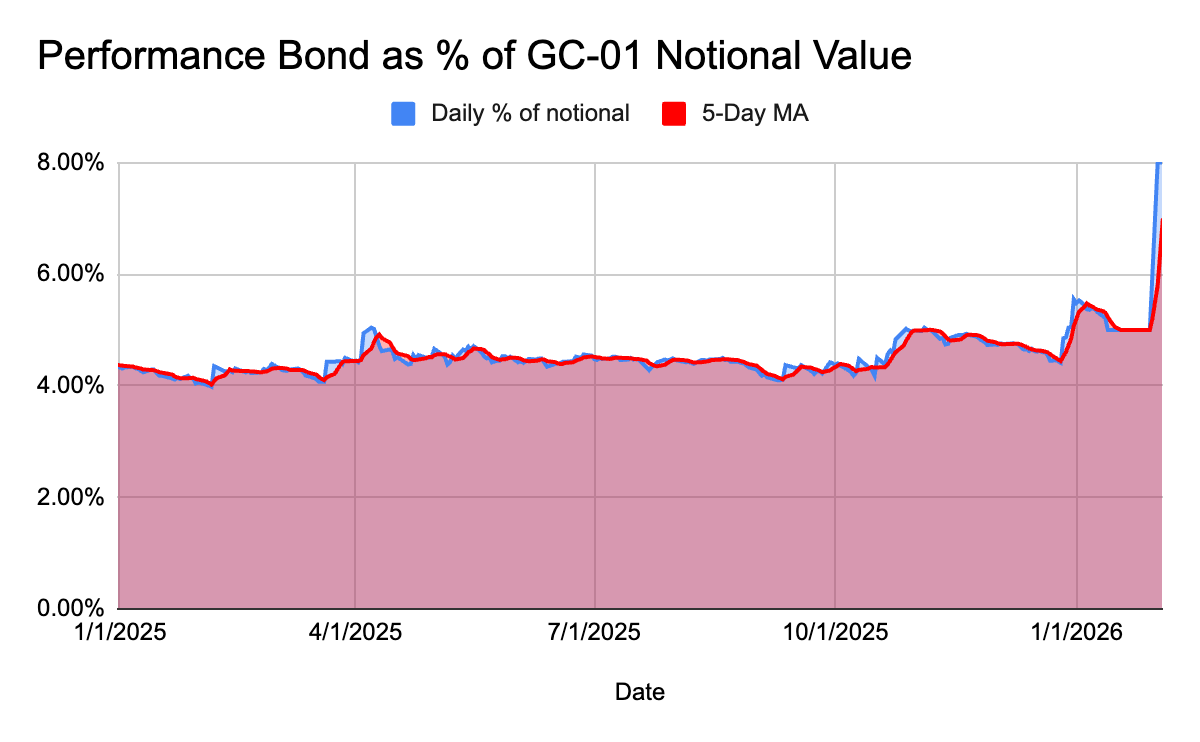

But on January 12th, they changed that policy. No longer are performance bonds fixed by dollar value, but now they are a fixed % of notional value for the contract.

That means, now, with each small price swing, market participants will be forced to wire CME cash every single day the price moves against them. For slow moving businesses in the metals industry, this means their balance sheet just become a hot radioactive bowl of soup.

Throughout the week this was implemented, prices across commodities markets were in line with historic trends — so no one needed to change their cash position.

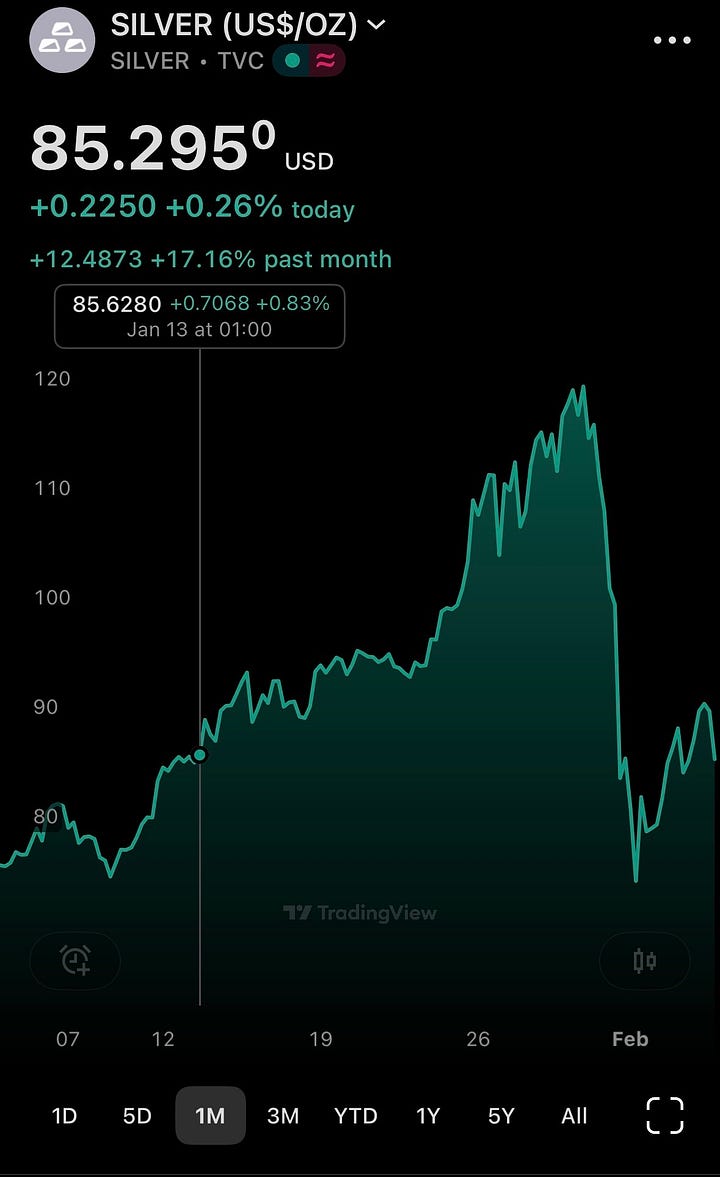

But that changed after a major price move on Jan 16th. The price move on that day was consistent the historical volatility window — but what has happened since January 16th has been nothing short of extreme.

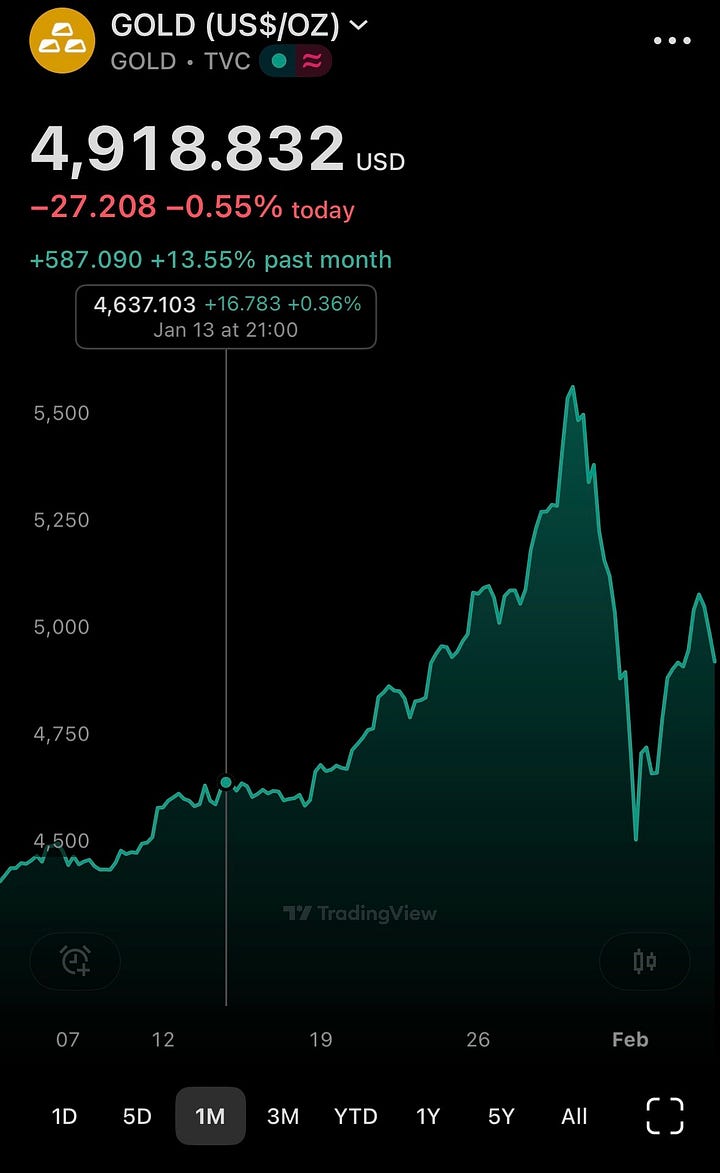

This is what the silver and gold charter looks like since those breakouts under the new policy regime:

Notice anything different? Here, let me help:

Similar extreme volatility has happened across other commodities markets since this announcement, from precious metals to base metals to LNG. So no, gold is not structurally a meme stock - CME just decided to change the rules - and that new paradigm has wreaked havoc on price discovery.

Then January 29th happened.

2. CME quickly thereafter hiked performance bonds to a rate never before seen.

Second false narrative from the talking heads: “Warsh, the precious metals Grim Reaper4, is Volker 2.0”

This is also obviously false. In order for Warsh to be Volker 2.0, with the capacity to crush the precious metals rally, the Federal Government would need a very different balance sheet.

Today, Debt/GDP is at 120%; a strong dollar5 is not an option for this new chairman. At the end of the major precious metals run in the 1970s, Debt/GDP was 30%. At that time, Volcker possessed the capacity to tighten monetary policy, because the Federal Government could afford to temporarily pay more interest with higher deficit spending. Today, that is not an option.

TLDR; the talking heads are dumb, but the markets are smart; the price-insensitive buyers and sellers of metals know this.

So what actually caused the crash?

Structurally, the new CME policy creates more stress for shorts (sellers of metals): as the price moves up, so does the performance bond. But for longs (buyers of metals) as the price moves down, so does their cash requirement.

To avoid runaway commodities prices, CME did something insane by historic standards. Traditionally, CME doesn’t move their performance bond minimums by more than 10% in a given notice period (so if one day it was $2,000/contract, the next day it might be $2,200 per contract). Departure from this custom in response to the run-up is actually what caused the crash.

With runaway prices across the metals industry, in a 2 day span, CME took their policy rate for gold from 5% of notional to…. wait for it…. 8% of the notional value of a contract (with similar hikes from 9% to 16% for silver).

As you can see, Jan 13 is when they imposed their new 5% flat rate as a percent of notional, and then followed it up with a sharp incline on Jan 29. What did this mean for market participants?

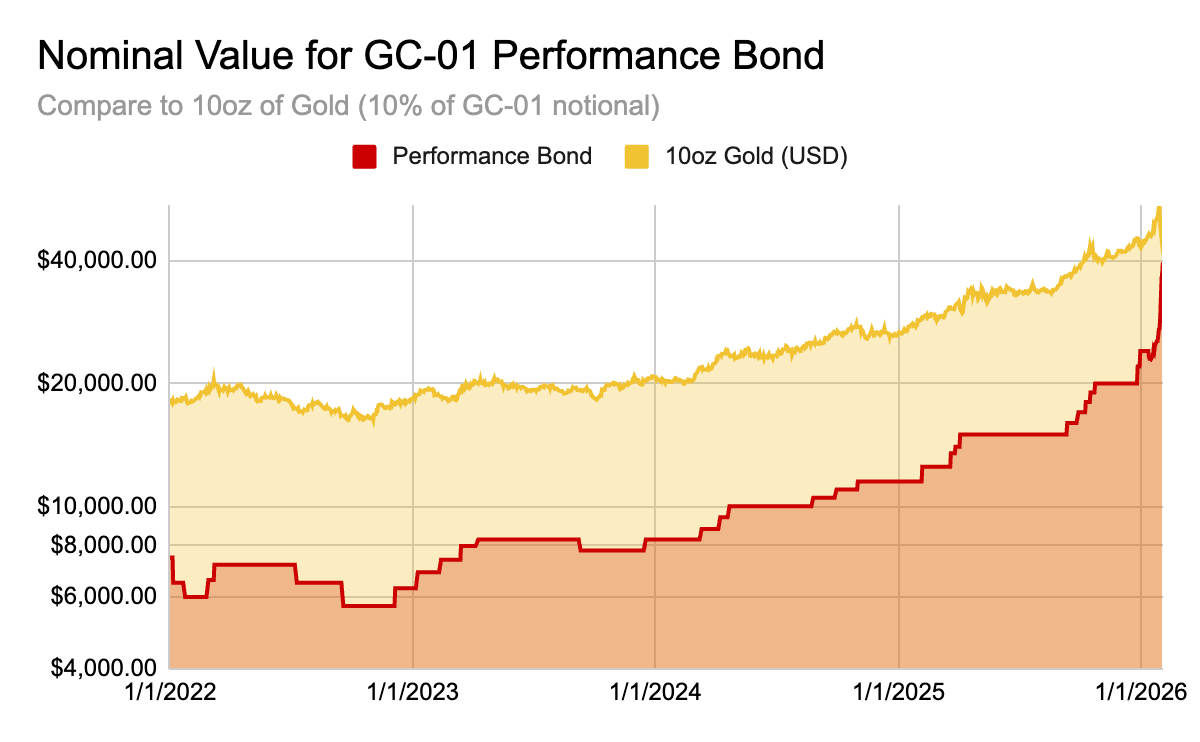

Below is a chart for the nominal jump in the performance bonds when compared to 10oz of gold (namely, 10% of a futures contract):

In summary, in just 1 month, CME has raised their cash requirements by 100%. For anyone that knows anything about the settlement and payments friction that plagues metals industries, you can appreciate that for many businesses this is existential (more on that below).

So yes, leveraged speculators absolutely crashed the price - from retail investors trading tokenized ETFs, to large investment banks running a commodities desk - but that’s tautologically true of every flash crash.

The question is not why liquidity dried up, but rather what initiated this run on the market. To answer that question, the devil is in the details - and the answer is pretty clear: it was CME hiking their rates by 60% in less than 48 hours.

This is a lesson for anyone trying to build a new futures exchange - be slow and boring; set your policy, and stick to it. And if you must to do something dramatic for survival, make sure the market renormalizes before making another major move. As a commodities exchange, your job is to set the rules, not move the market.

Before moving on, I’ll editorialize a little bit:

If you find yourself in existential circumstances as a commodities exchange, needing major reforms to stay alive at the 11th hour, then maybe you should fire the people that couldn’t identify the structural shifts that every goldbug and macro investor with a twitter account has been yapping about since March 2023….

Just a thought.

3. Paper policy has created real stress in physical reality.

So what does this look like on the ground? I’ve seen the effects of this new policy first hand.

With my company, I have seen how mismanaging liquidity with metals inventory can be existential for a business: not because you are insolvent, but because the cash you need comes too late. I learned this first hand over the holidays, but that’s a story for another day.

This experience forced me to build risk tools that helped me to read the tea leaves of the metals rally in mid January - and so by Wednesday afternoon, anticipating a high probability for a dramatic move from CME, I moved 85% of my balance sheet to cash.

To anticipate moves like this, you need to understand how the incentives for futures exchanges differ dramatically from their market participants. Unlike metals operators, CME doesn’t care about volatility - they care about (1) delivering on open interest (which is existential to their business), and (2) creating liquidity for members by incentivizing market participants to speculate - in that order.

So after the crash, what have I been doing this week?

After the carnage last Friday, this Monday I was running around Chicago buying up gold bars from bullion dealers to provide liquidity, so they could get through the week, and so I could rebuild my inventory for customers. Even for these precious metals kingpins, sometimes Cash is still King.

To keep spreads tight as volatility grows, metals businesses must prioritize risk management and settlement. In the past year, 10% price swings have gone from a monthly occurrence, to a daily possibility; but physical metals operators still live in the 20th century. They wire payments, cash checks and vibe their way through hedging and balance sheet management with excel spreadsheets.

To combat this, metals companies desperately need new payment rails and treasury management systems that live in the 21st century. This technology deficit is what actually drives up spreads - and it’s the main reason retail investors can’t buy and sell hard assets at spot prices.

The entire industry is held captive by over-financialized exchanges that inadvertently moves the market when faced with their own survival. This is the reality; and as supply chains continue to shift, and metals continue their rally, price shocks will become the norm.

Bullion dealers, wholesalers, and refiners all feel this balance sheet stress in the short term — dealers are cash strapped when spreads are wide and price action swings, and wholesale & refiners are forced to deliver performance bonds when they need the cash the most. But in the long term, this new volatility regime, will have an even more insidious effect on our mining industries.

JD Vance made an excellent point during his speech today at the newly established Critical Mineral Ministerial: price volatility kills project financing for miners. If you don’t stabilize commodities prices in the West with more performant technology to combat the exogenous policy shifts of CME, you’ll either have to resort to price floors OR you will see the US mining industry die in the rubble.

In Conclusion

(1) CME’s policy shift has created the recent volatility in commodities markets; (2) their margin hike caused the flash crash on January 30th; and (3) this has created real world stress for physical metals operators - some of which is existential.

With that, expect the first newsletter in The Great Reset Series sometime this week.

That’s all for now.

This newsletter definitely went on longer than expected. Maybe next time I’ll give myself a 20 minute cap.

Good Lord this is long. Next time I promise, brief and direct.

Which roughly means, CME expects metals to fluctuate no more than 3-5% in any given day. If they did, then shorts & longs could potentially run a negative balance at the end of the day when members are required to re-up their margin.

No one has called him that (yet) - I just added that for color.

Technically… you could strengthen the currency if you made it domestic, but the world would need to dedollarize; and to do so, countries would need a new settlement instrument other than USD for global trade.